Introduction

When it comes to NUKK Stock, the buzz is hard to miss. NU Holdings Ltd., a growing player in the economic services sector, has been making waves in the venture world, prompting investors to keep a close eye on its marketplace performance. Whether you’re an experienced investor or just someone with a Robinhood account observing for the next big thing, here’s all you need to recognize about NUKK.

What is NU Holdings Ltd.?

NU Holdings Ltd. functions as a digital financial services stage, primarily known for its innovative method to banking in Latin America. The business’s flagship creation, Nubank, has transformed access to banking services for lots.

Here’s why it’s gripping attention:

| Feature | Details |

| Headquarters | São Paulo, Brazil |

| Market Focus | Digital banking in Latin America |

| Key Products | Credit cards, personal loans, and insurance |

| Customer Base | Over 70 million users as of the latest data |

Why NUKK Stock Is Trending Now

Investors are talking about NUKK stock due to a mix of factors:

- Recent Earnings Report:

NU Holdings recently posted its quarterly earnings, exceeding market expectations. This has sparked optimism about its growth trajectory. - Expansion Tactics:

The company has broadcast plans to expand its product portfolio, possibly tapping into profitable new markets. - Strong Market Position:

As a leader in digital investment in Latin America, NU Holdings has located itself as a disruptor in a usually underserved market. - Tech-Driven Growing:

Its reliance on knowledge and AI to streamline financial facilities sets it apart from competitors.

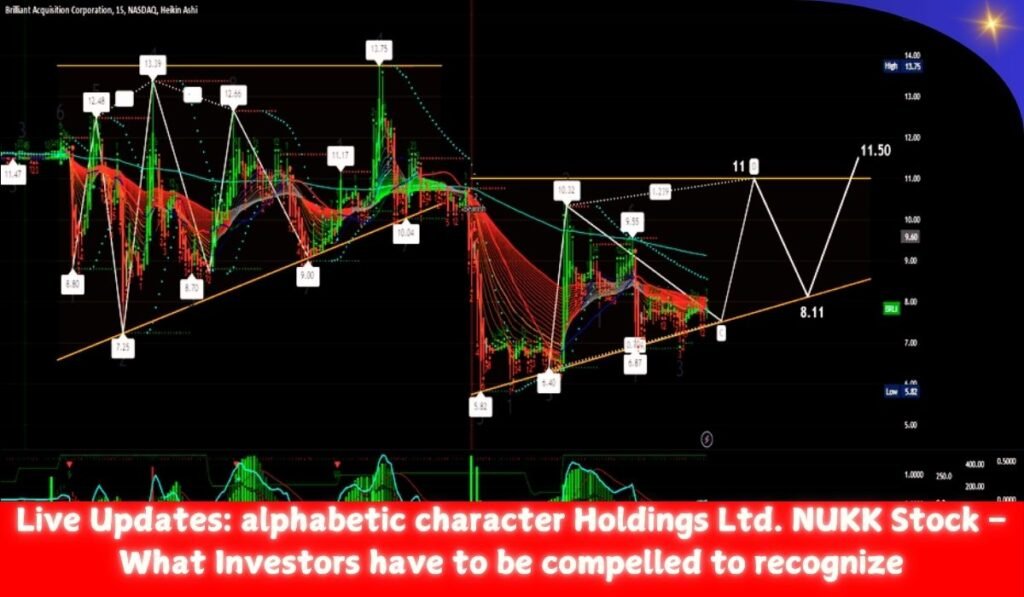

Stock Performance at a Glance

| Metric | Current Value | Last Quarter | Year-to-Date Change |

| Stock Price (USD) | $5.32 | $4.80 | +10.8% |

| Market Cap (Billion) | $25.6 | $23.5 | +8.9% |

| P/E Ratio | 18.7 | 19.3 | N/A |

Why Investors Are Excited

- Growth Possible:

NU Holdings is not just a local victory story; it has the potential to produce a worldwide fintech powerhouse. - Young Customer Base:

With an important hunk of its users being millennials and Gen Z, the corporation welfares from a tech-savvy and loyal spectators. - Low-Cost Model:

By operating as a digital-first bank, NU Holdings keeps operational costs low, maximizing profitability. - Market Momentum:

Recent upgrades from major analysts suggest that institutional investors see potential in the stock.

Risks to Consider

Before you dive headfirst into NUKK, here are some potential risks:

- Market Volatility:

Emerging market pillories, especially in fintech, can knowledge high volatility. - Competition:

Other players in the numerical banking space, both regional and worldwide, are ramping up their efforts. - Regulatory Contests:

Operating across multiple countries with different financial regulations can be tricky. - Macroeconomic Issues:

Economic go-slows or currency fluctuations in Latin America could influence the company’s performance.

Top Tips for Investing in NUKK Stock

- Do Your Research:

Dive into financial statements and recent earnings reports. - Monitor Market Conditions:

Keep an eye on Latin American markets, as they heavily influence NUKK’s performance. - Think Long-Term:

Fintech stocks like NUKK often require a long-term perspective. - Diversify:

Don’t put all your eggs in one basket—consider NUKK as part of a diversified portfolio. - Stay Updated:

Follow news about NU Holdings and the broader fintech industry.

Conclusion

NUKK stock is irrefutably one of the most fascinating fintech plays on the market right now. With its innovative method of banking and massive customer base, NU Assets has significant growth latent. However, as with any investment, it’s vital to weigh the risks against the plunders.

For those eager to embrace a bit of market uncertainty, NUKK’s strength just be a ticket to riding the fintech upsurge in Latin America—and possibly outside.

FAQs

Q: Is NUKK stock a good buy right now?

A: Analysts are cautiously optimistic, citing its growth potential. However, do your research and consider your risk tolerance.

Q: What makes NU Holdings different from traditional banks?

A: Its digital-first approach and emphasis on user-friendly interfaces set it apart.

Q: Does NU Holdings pay dividends?

A: No, NU Holdings currently reinvests profits to fuel growth.

Q: What’s NUKK’s future growth outlook?

A: With plans to expand in Latin America and possibly beyond, the growth outlook is strong, but competition and economic factors could play a role.