Introduction

States Without Income Tax, When it involves managing your finances, finding ways in which to stay additional of your hard-earned cash is often a win. One of the foremost talked-about ways resides in states while not taxation. Imagine not having a bit of your payroll check disappear before you even get to touch it. Appears like a dream, right?

Nine states within the u. s. provide this money perk, which might be a game-changer for several Americans. Whether or not you’re trying to stretch your retirement savings, maximize your earnings, or just escape the IRS’s long arm (legally, of course), these states will assist you keep more money in your pocket. However, before you pack your luggage and head for untaxed paradise, it’s necessary to grasp what living in these states extremely means.

In this article, we’ll explore the 9 states while not taxation, what they provide, and also the trade-offs you ought to contemplate before creating the move. Let’s dive in!

What are the States while not have financial gain Tax?

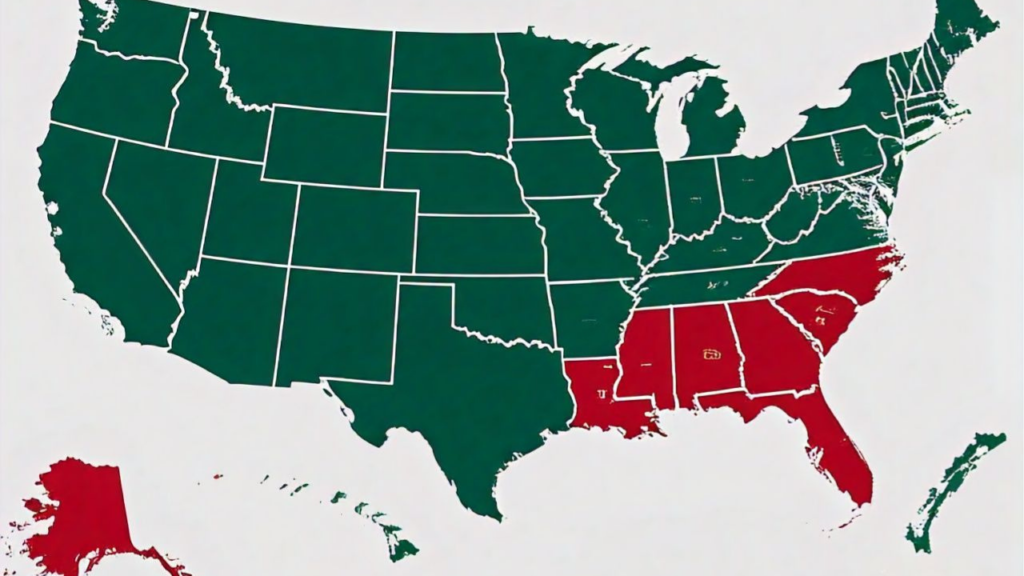

Currently, 9 states within the U.S. don’t levy private taxation. These are:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

While not paying taxation appears like a rapid win, there’s additional to the story. Several of those states frame for the dearth of taxation by increasing alternative taxes, like sales taxes or property taxes. Let’s take a more in-depth cross-check of what every state needs to provide.

1. Alaska: The Frontier for Tax Freedom

Alaska isn’t simply a nature lover’s paradise; it’s conjointly a haven for those trying to avoid financial gain taxes. In fact, AK goes a step further by paying its residents associate annual dividends through the Permanent Fund, which is funded by oil revenue.

However, Alaska’s remote location and better price of living will be drawbacks. Groceries and products are usually costlier thanks to transportation prices, thus whereas you save on taxation, alternative expenses will move on.

2. Florida: Sunshine and Savings

Florida’s heat weather, beaches, and 0 taxation make it a high selection for retirees and remote staff. The state’s economy thrives on business enterprise, that helps offset the dearth of taxation through sales taxes and charges.

While the dearth of taxation could be a huge perk, Florida’s property taxes will be on the upper facet, particularly in common cities like Miami and urban centers. Still, the mix of a tax-friendly setting and sunny lifestyle makes Everglade State a favorite.

3. Nevada: No Taxes, All Action

Home to the city, Battle Born State is thought for its amusement, nightlife, and 0 taxation policy. The state depends heavily on business enterprise and gambling revenue to fill its coffers, thus you’ll realize higher sales taxes here.

For those in industries like amusement or welcome, Battle Born State will be a profitable place to measure. However, outside of urban hubs like the city and Reno, job opportunities will be restricted.

4. New Hampshire: untaxed for Earners, however Not for Shoppers

New Hampshire doesn’t tax attained financial gain or wages, however it will tax dividends and interest. This makes it a variety for those looking forward to investment financial gain.

The state conjointly has no nuisance tax, which could be an immense bonus for customers. However, property taxes in New Hampshire are a number of the very best within the country, thus owners ought to set up consequently.

5. Mount Rushmore State: easy and untaxed

South Dakota is one of the foremost tax-friendly states within the U.S., with no taxation and comparatively low property taxes. The state’s economy is supported by agriculture, tourism, and money services.

While the value of living is low, South Dakota’s rural nature won’t be attractive to everybody. It’s nice if you like wide-open areas, however, town slickers may realize it is a touch too quiet.

6. Tennessee: A Growing Untaxed Haven

Tennessee recently phased out taxes on dividends and interest, formally change of integrity the ranks of states with no taxation. Proverbial for its music scene and growing cities like Nashville, Tennessee is changing into a hot spot for young professionals and retirees alike.

Sales taxes in Tennessee are among the very best in the nation, however overall, it’s an excellent state for those trying to avoid financial gain taxes while enjoying a thriving cultural scene.

7. Texas: huge State, huge Savings

Texas is one of the foremost common states while not taxation, because of its strong economy and business-friendly policies. With no taxation and a coffee price of living in several areas, Lone-Star State could be a magnet for firms and people alike.

However, property taxes in Lone-Star State will be steep, particularly in speedily growing areas like the state capital and metropolis. Even so, the dearth of state taxation usually outweighs the upper property taxes for several residents.

8. Washington: No taxation, however, be careful with nuisance tax

Washington State doesn’t have revenue, however, it makes up for it with one of the very best nuisance tax rates in the country. If you’re a high spender, those sales taxes will add up quickly.

The school trade is booming in cities like Seattle, creating Washington an excellent selection of professionals in fields like software package engineering and innovation. Simply be ready for the upper price of living in urban areas.

9. Wyoming: The Quiet Untaxed Frontier

Wyoming offers wide-open areas, a coffee price of living, and no taxation. The state’s economy depends on energy production, agriculture, and business enterprise.

While WY could be a tax-friendly possibility, it’s not for everybody. The state’s rural nature means that fewer amenities and restricted job opportunities compared to alternative states on this list.

The Trade-Offs of Living in a very untaxed State

While moving to a state while not have taxation sounds appealing, it’s necessary to weigh the professionals and cons. Several of those states make amends for the dearth of taxation by increasing alternative taxes, like sales, property, or excise taxes.

For example:

- Florida has higher property insurance prices thanks to its hurricane-prone location.

- Washington’s nuisance tax will considerably impact your price of living.

- New Hampshire offsets its lack of nuisance tax with high property taxes.

It’s essential to appear at the complete tax picture—not simply financial gain tax—when deciding if moving to an untaxed state is true for you.

Who advantages Most From Moving to an untaxed State?

States while not taxation are notably appealing to:

- High Earners: If you’re in a very high bracket, avoiding state taxation will prevent thousands of greenbacks annually.

- Retirees: Those living on fastened incomes usually enjoy avoiding state taxation on retirement savings or social insurance advantages.

- Remote Workers: the increase in remote work makes it easier than ever to measure in a very untaxed state while operating for firms placed elsewhere.

However, if you’re not earning a high financial gain, the savings won’t outweigh the upper prices in alternative areas.

Conclusion

Living in one of the 9 states while not taxation will be an incredible money move, however, it’s not a one-size-fits-all resolution. Whereas these states provide important savings on taxation, they usually frame for it in alternative ways, like higher sales or property taxes.

Before creating a move, contemplate your money state of affairs, lifestyle preferences, and semipermanent goals. Whether or not you’re drawn to Alaska’s rugged beauty, Texas’s booming economy, or Florida’s sunny beaches, there’s an untaxed state that may be the proper acceptable you.

After all, the United Nations agency wouldn’t need to stay additional of their paycheck. Simply certify you are doing the mathematics before career the movers.

FAQs

What are the 9 states while not have financial gain tax?

The states are AK, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and WY.

Do states while not taxation have higher sales taxes?

Many do, like Washington and Battle Born State, that have faith in sales taxes to come up with revenue.

Is it value moving to an untaxed state?

It depends on your financial gain, lifestyle, and also the trade-offs you’re willing to create, like higher property or sales taxes.

Which untaxed state is the best for retirees?

Florida could be a common selection for retirees thanks to its lack of taxation and heat climate.

Do untaxed states tax social insurance benefits?

Most states while not taxation conjointly don’t tax social insurance advantages, making them appealing for retirees.